Paul Morigi/Getty Images Entertainment

“Be fearful when others are greedy, and greedy when others are fearful” – Warren Buffett

Written by Sam Kovacs

Introduction

Man do I love Uncle Warren.

How many of us have been profoundly impacted as investors from his philosophy?

Every time I write an article, I can easily think of a quote of his which will be relevant to what I’m writing.

It makes it easy for me to select a cover photo for my articles, and it turns out people love to click on his likeable grandpa face.

Back in college, I read and took notes on every single one of his letters to shareholders.

I figured that I might have had a thing or two to learn from him.

But over time what I’ve found out, is that you can’t just take one sentence and apply it badly.

Case in point. Being greedy when others are fearful, does not mean be stupid when others are fearful.

I have a couple friends who decided to buy the TERRA LUNA (LUNA-USD) cryptocurrency after it tanked 99%. I told them it would likely tank again as the crypto has infinite supply and was hyperinflating in an effort to reinstate their stablecoin’s peg.

They got wrecked, as it plummeted another 99%.

When others are fearful of proven assets, then yes it is a good time to be greedy. When others are capitulating, it’s the time to pounce.

Why markets are going higher

I shared this chart with members of the Dividend Freedom Tribe, just over a week ago.

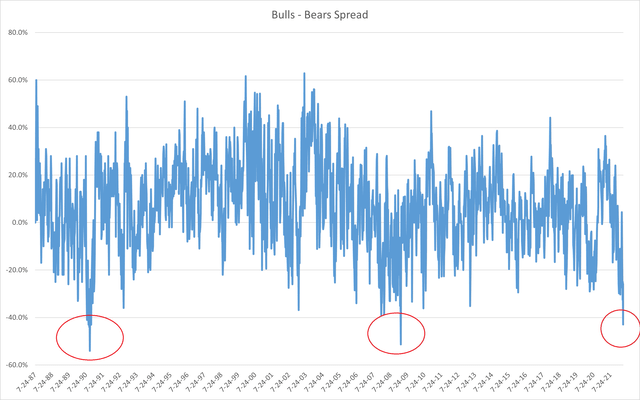

It shows AAII’s investor sentiment survey.

Each week, they poll individual investors on their overall sentiment, asking if they identify as bullish, neutral, or bearish.

While these data points are quite interesting in isolation, they come to life when we calculate the spread between bulls and bears.

Looking at the Spread, we realize that April 27th marked the 3rd most bearish spread ever recorded since AAII started its survey back in 1987.

The two other periods were October-November 1990, and March 2009.

Both these extreme bearish readings preceded two huge bull markets.

In other words, when a majority of people agree the market is going down, and only very few believe it is still going up, it usually bottoms quite soon afterwards.

And this makes sense. Where can all the excess money that was printed and found its way into the financial system go?

Holding cash is losing 8% per year to inflation. Holding bonds guarantees losses from the Fed’s rate hikes over upcoming quarters.

You can’t have everything in gold, crypto, canned food and collectibles, so it needs to go into stocks.

Real rates are still deeply negative and will be for a long time. This is stimulatory, not restrictive fiscal policy. And it is likely going into stocks which make good substitutes for funds exiting bonds. Stocks with yield. If they have inflation protection baked in through dividend growth, even better.

The chartists would agree with me here too.

All of you know that I’m a fundamentals driven guy.

I used to shun technicals as useless, without really taking time to learn about them or implement them.

What was I to do? All the academics in business school told me these were stupid.

But gradually, I started to realize that my market views as dictated by the fundamentals tended to coincide with Seeking Alpha’s favorite chartist’s views.

I put all the stereotypes I had aside, and decided to learn about Elliott Wave Theory. I read all the books, and decided to apply it to Bitcoin (BTC-USD) in 2020. I made 5x my money.

Since then, I use them as a tool. Not as my only tool, but as part of the arsenal. Just like a pilot has many dials in his cockpit, the investor can leverage a multitude of tools.

The charts say, this is likely the bottom.

So:

- Mass capitulation within the investment community.

- Charts signal a bottom.

- Fundamentals suggest money continues to flow into stocks.

So much time and money can be lost in anticipation of bear markets, when the anticipation is driven by fear and not rationale.

Markets are going higher. These 3 stocks are now mispriced because of the fear, and dividend investors will likely do great by buying them.

Buy Intel

The first stock I want to highlight is Intel (INTC). Intel is clearly the incumbent in the semiconductor market with competitors such as AMD (AMD) and QUALCOMM (QCOM) having snatched market share in the past few years.

I criticized Intel’s management a couple years ago for their over-compensation and lack of innovation.

Since then though, Gelsinger, Intel’s first CTO, has come back to the company as CEO, to drive Intel through the next wave of innovation, with the core opportunity being in growing Intel’s foundry.

For those of you who aren’t up to date with the semiconductor industry, fabless companies such as Broadcom (AVGO) design but don’t manufacture the chips. They will use excess manufacturing space from other companies, called foundries.

Intel has long built its own chips for CPUs, but with declining PC demand from the consumer market post Covid, investors have turned bearish on Intel.

And that is quite fair, and the bearishness could last for a while, as no good news comes from the declining consumer demand.

As fellow SA author, Convequity put it in their excellent article on Intel:

Gelsinger returned with a lot of hope, and it is probably the most high profile turnaround story of 2021. However, investors were probably placing too much optimism on Gelsinger’s ability to suddenly right the ship and improve margins and growth within a very short period of time. This might be the case for highly dynamic software or consumer brands. For INTC, however, the capital investment cycle, the product launch cycle, and the talent acquisition cycle are measured by years, if not decades. Thus, following several quarters of lacklustre and/or zero surprise earnings releases, investors’ patience over INTC’s turnaround story appears to have worn out.

But for the patient dividend investor, this works out nicely.

We have long advised members of the Dividend Freedom Tribe to buy Intel below $45 and start selling above $60.

This coincides nicely with the stock’s historical dividend yields. In the past decade, INTC has yielded a median 2.8% yield. During the past 5 years, this has gone down to 2.5%.

Either way, this is not enough yield for dividend investors to get full compensation.

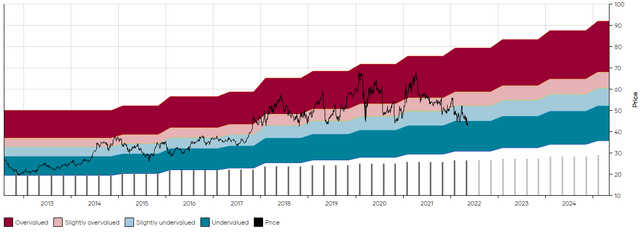

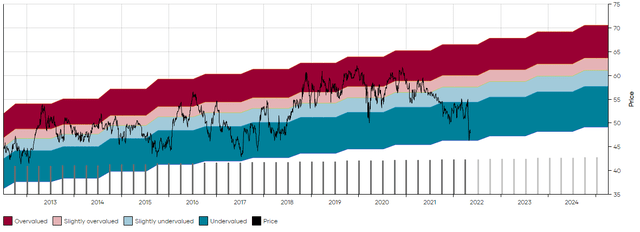

Dividend Freedom Tribe – INTC MAD Chart

Given Intel’s long term dividend growth prospects of 5% to 7% from both earnings and payout ratio expansion, a yield of 3% to 3.5% is required for dividend investors to be fully compensated.

This doesn’t happen so often with Intel, as the blue chip chipmaker’s moat in the semi-conductor business usually pushes its valuation up.

Today, because of the current macro and micro, Intel can be picked up for a great price.

Buy JP Morgan

JPMorgan (JPM) was one of the banks which performed very well for us in 2021, after we bought the stock at an average cost of $109 in late 2020 and early 2021.

This lasted for a while, and the stock unfortunately came within $9 of our $180 sell target which meant we ended up holding the bag as it came back down.

Financial stocks still haven’t quite had their day in the sun, and I believe that in the next leg up, banks will finally get their time.

High quality banks abound in the US, and while we love Morgan Stanley (MS), Bank of America (BAC) and others, JPM’s quality and leadership remains second to none.

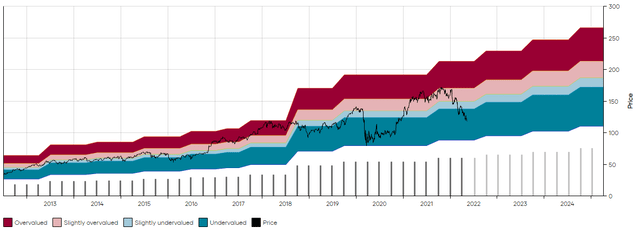

During the past 10 years the stock has had a median yield of 2.7% which is compensation when you bake in the double digit dividend growth.

At the current price of $118, it yields 3.3% making it a strong buy.

Dividend Freedom Tribe – JPM MAD Chart

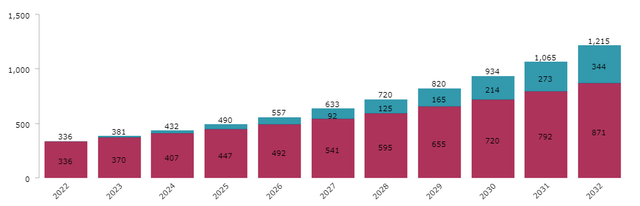

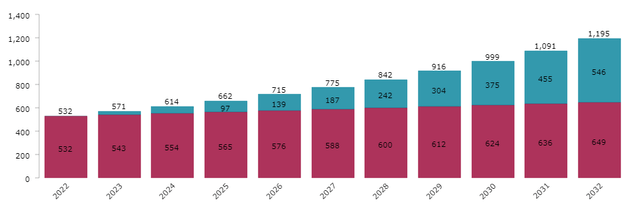

If you invest 10K in JPM today, and reinvest dividends while the dividend payment grows at 10% per annum, then in year 10 you can expect to receive $1215 , or 12.15% of your original investment. A very attractive dividend play.

Dividend Freedom Tribe – JPM Dividend Simulation

Buying the highest quality assets at a discount is always a surefire way to succeed.

Buy Verizon

The final pick in today’s list is Verizon (VZ) which I wrote about on May 2nd suggesting that if the stock could stay above $46, the bottom would be in, as this level was multi decade support.

The company has an entrenched moat in the communications sector, and while you don’t get much dividend growth — no more than 2% per year should be expected — you do get a huge 5.3% dividend yield.

Dividend Freedom Tribe – VZ MAD Chart

If the pendulum swings, as I expect it will for all quality stocks, then VZ could see its price appreciate to the $60s.

You get paid dearly to wait and buy VZ at historical lows, relative to the dividend.

If you invest 10K in VZ today, and the dividend grows at 2% per annum, then 10 years from now you’ll receive annual income of $1195, or a 11.95% yield on your original investment.

Dividend Freedom Tribe – VZ Income Simulation

As you can see from the VZ and JPM income simulations, you can get satisfactory future income with different combinations of yield and growth.

More growth requires less yield, and vice versa.

Conclusion

High quality dividend stocks will be the bread and butter of the next leg up.

This is not a bear market, at least I’m willing to write this again and again. I’m 90% confident that this market will see new highs before the full cycle comes to an end.

Buying the highest quality assets now that they are at great prices, is the way to go.

Buy low, sell high, get paid to wait.

Read More: 3 Blue Chip Dividend Buys Before S&P 500 Skyrockets To 5,000