FEARS OF VOLATILITY:

Fueling Omicron concerns, Pfizer said that the pandemic could extend through next year, while the Fed plans to end stimulus sooner

Wall Street finished lower on Friday, weighed down by Big Tech as investors worried about the Omicron variant of SARS-CoV-2 and digested the US Federal Reserve’s decision to end its COVID-19-era stimulus faster.

All three main US indices declined for the week after the Fed on Wednesday signaled three quarter-percentage-point interest rate hikes by the end of next year to combat surging inflation.

Nvidia Corp dropped 2.1 percent and Alphabet Inc lost 1.9 percent, both weighing on the S&P 500 and NASDAQ.

Photo: Reuters

The S&P 500 growth index lost 0.7 percent and the value index declined 1.4 percent.

All of the 11 major S&P 500 sector indices fell, with financials leading the way down with a 2.3 percent drop. Energy lost 2.2 percent.

Adding to uncertainty, Pfizer Inc on Friday said that the COVID-19 pandemic could extend through next year.

European countries geared up for further travel and social restrictions and a study said that the rapidly spreading Omicron variant was five times more likely to reinfect people than the Delta variant.

Traders also pointed to year-end tax selling and the simultaneous expiration of stock options, stock index futures and index options contracts — known as triple witching — as potential causes for volatility.

“It’s a big options expiration day, and now you draw on top of that some Omicron, and you’ve got volatility, and I think it creates a lot of uncertainty amongst investors,” said Joe Saluzzi, comanager of trading at Themis Trading in Chatham, New Jersey. “Where are you going to position for the end of the year?”

Heavyweight growth stocks including Nvidia and Microsoft Corp have outperformed the broader market this year, while the Philadelphia SE Semiconductor index has surged about 35 percent.

The benchmark S&P 500 index gained around 23 percent over the same period.

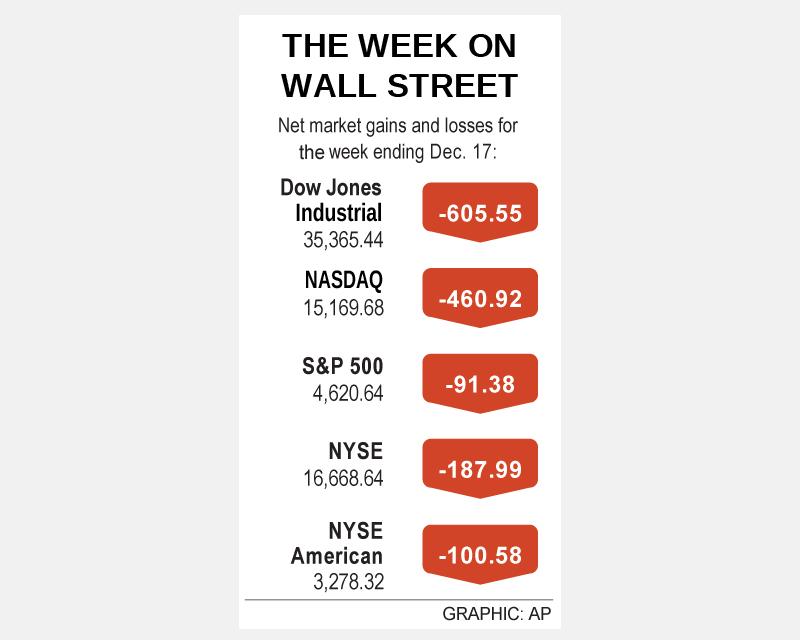

In Friday’s session, the Dow Jones Industrial Average fell 1.48 percent to close at 35,365.44 points, while the S&P 500 lost 1.03 percent to 4,620.64, and the NASDAQ Composite dropped 0.07 percent to 15,169.68.

On a positive note, the small-cap Russell 2000 index rallied 1 percent after having fallen more than 10 percent from a record high early last month.

With options expiring, volume on US exchanges jumped to 16.6 billion shares, far above the 11.9 billion average over the past 20 trading days.

For the week, the S&P 500 dropped 1.94 percent, the Dow lost 1.68 percent and the NASDAQ declined 2.95 percent.

Declining issues outnumbered advancing ones on the NYSE by a 1.50-to-1 ratio; on the NASDAQ, a 1.16-to-1 ratio favored advancers.

The S&P 500 posted 22 new 52-week highs and seven new lows; the NASDAQ Composite recorded 28 new highs and 341 new lows.

Comments will be moderated. Keep comments relevant to the article. Remarks containing abusive and obscene language, personal attacks of any kind or promotion will be removed and the user banned. Final decision will be at the discretion of the Taipei Times.

Read More: Wall Street pulled down by Big Tech – Taipei Times