In recent weeks, crude oil prices have spiked from their already-high levels due to Russia’s invasion of Ukraine. West Texas Intermediate (WTI) crude, the main U.S. benchmark, topped $130 a barrel at its March peak due to supply concerns. Oil prices have cooled off since then, with WTI trading back below $100 a barrel for much of the past week.

Even so, oil companies are still cashing in at the current levels, and they could make their shareholders a lot of money if oil prices remain elevated. Three oil stocks that still look like particularly great buys to some of our energy sector contributors right now are TotalEnergies ( TTE -0.46% ), ExxonMobil ( XOM -0.39% ), and ConocoPhillips ( COP 0.78% ).

Image source: Getty Images.

Diversifying from its core businesses

Reuben Gregg Brewer (TotalEnergies): Oil prices rise and fall, often in dramatic fashion. So the current volatility, while driven by frightening geopolitical events, isn’t out of the norm. This is why more conservative investors should stick with integrated energy giants like France’s TotalEnergies. Its business spans the globe, and ranges from the upstream (drilling) segment to the downstream (refining and chemicals). It’s built to ride the industry’s often troubled seas.

However, beyond that, TotalEnergies is doing a little something more that could prove just as important for its future. It is starting to move into the “electrons” business, with investments in solar, wind, and electric utility assets. Basically, management sees the ESG writing on the wall, and it’s using the funds from its hydrocarbons business to build out a new clean-energy division. It is prepared for the here and now, and is increasingly prepared for an energy future in which oil and natural gas aren’t quite as prominent. This transition is likely to take a long time, so there’s no rush, but TotalEnergies is at the forefront of the industry in addressing the carbon emissions issue.

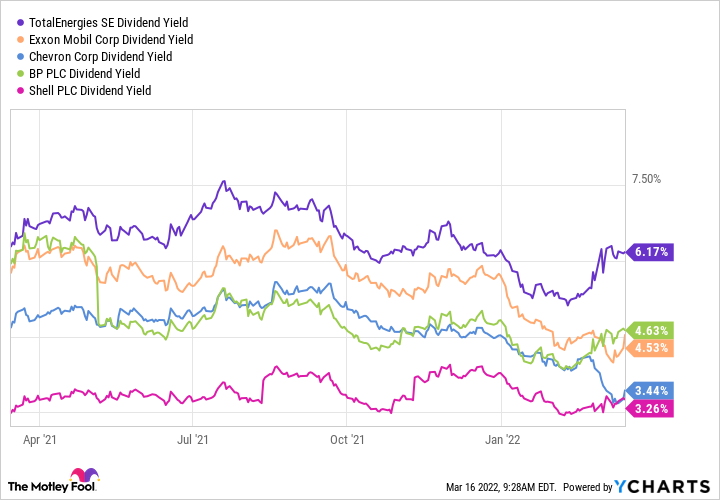

TTE Dividend Yield data by YCharts.

Investors, meanwhile, can collect a generous dividend that yields 6.1% at current share prices while they sit back and let management adjust to the changing energy landscape. That’s the most generous payout among the oil majors. That said, TotalEnergies is a French company, so foreign taxes will be withheld from the dividends you receive, but you can claim those back when you file your annual U.S. taxes. If you’re looking for an oil play that’s built for today and tomorrow, this high-yield stock could be a great option for you.

Solid shareholder return potential even if oil plunges 30% more

Neha Chamaria (ExxonMobil): ExxonMobil is one of the largest fully integrated oil companies in the world, and that’s just one of the big reasons why it belongs in your portfolio. Oil exploration and production companies — the upstream segment — stand to benefit the most from higher oil prices, which increase their margins on what they extract. Of course, the reverse situation holds true when oil prices fall, which is what makes an integrated player like Exxon so appealing.

ExxonMobil’s operations cover the entire value chain, from the upstream (extraction) to the downstream (refining and petrochemical production), and also markets refined products to consumers. So no matter where oil prices are, some parts of ExxonMobil’s business almost always stand to gain.

It also helps that this massive company makes good use of high-oil price environments to strengthen its financial standing in ways that position it to navigate tough times — and keep rewarding shareholders through them. That helps explain how ExxonMobil has been able to increase its dividend payouts for 39 consecutive years.

Right now, this oil major looks poised to generate huge cash flow, and a large chunk of that money should end up in shareholders’ pockets. Even at a Brent crude oil price of $60 per barrel, ExxonMobil expects its annual cash flow from operations to more than double by 2027 from its 2019 level. In short, ExxonMobil shareholders needn’t worry much about oil price volatility right now. Even in the worst-case scenario, you can at least bank on it to pay you a steady dividend, and that’s a good enough reason to consider this 4.1%-yielding oil Dividend Aristocrat.

A massive cash flow gusher still lies ahead

Matt DiLallo (ConocoPhillips): Oil giant ConocoPhillips closed two major deals last year to bolster its position in the resource-rich Permian Basin. It completed its $9.7 billion merger with Concho Resources in January, and acquired Shell‘s assets in that region for $9.5 billion in December. These deals increased its scale, helping lower its costs and positioning it to generate greater cash flow at lower oil prices.

As a result, ConocoPhillips estimates it can produce a cumulative $165 billion in cash flow from operations through 2031, assuming oil averages $50 a barrel. That would give it enough money to grow its production at a 3% compound annual rate while returning an estimated $75 billion to investors via dividends and share buybacks. The company noted that it could generate an additional $35 billion in cash flow from operations for every $10 change in average oil prices over that 10-year span.

So, while crude prices have cooled off a bit recently, ConocoPhillips is still on track to generate an enormous gusher of free cash flow in the coming years if prices stay in their current range. The company already plans to return $8 billion in cash to investors this year through its quarterly dividends, share repurchase program, and variable return of cash (VROC) distributions. ConocoPhillips has already boosted its VROC payment by 50% from its initial estimate due to high oil prices. It could pay out even more money in future quarters since oil remains well above its budgeted level. Meanwhile, with oil prices backing away from their recent peaks, ConocoPhillips’ stock has dipped from its highs — helpful for a company that is planning to repurchase at least $3.5 billion of its stock this year.

Put everything together, and ConocoPhillips could produce big-time returns for investors in the coming years.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis – even one of our own – helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

Read More: Oil Prices Are Falling, but These 3 Energy Stocks Are Still Great Buys | The Motley Fool