Art Wager/E+ via Getty Images

Introduction To Forestar Group

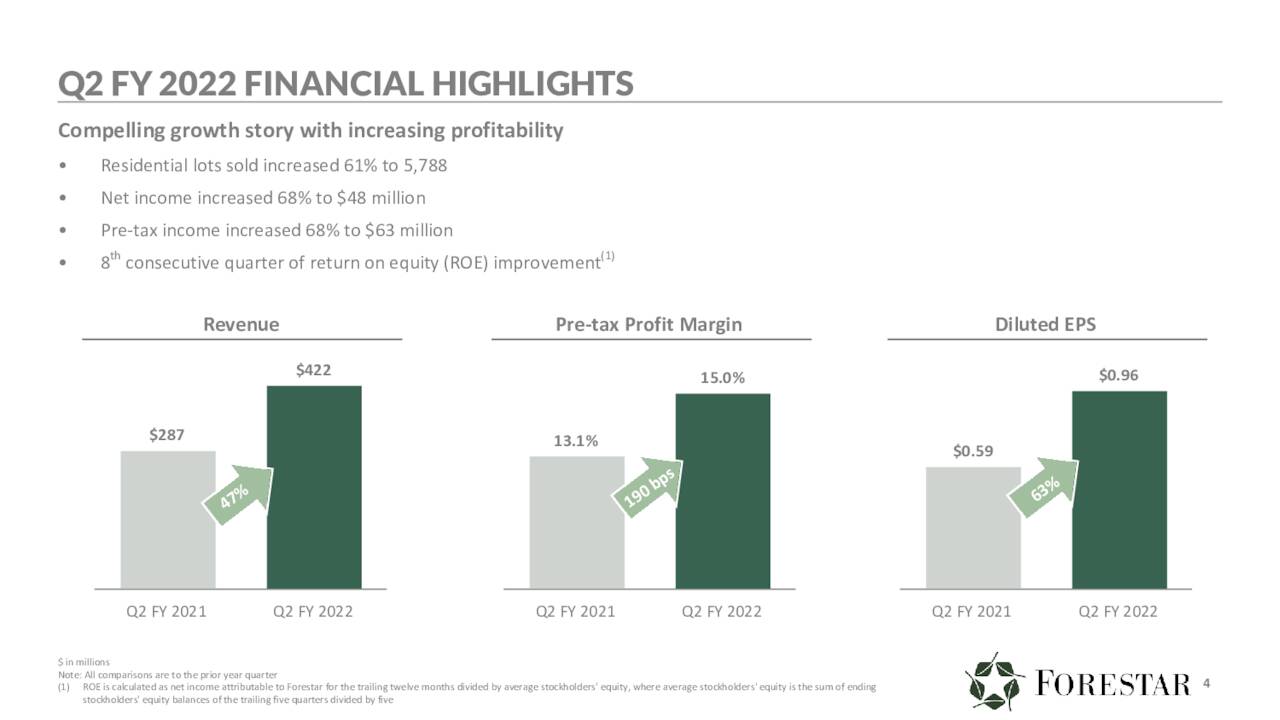

Forestar Group (NYSE:FOR) is a large land development company that has assets in 23 states across the US. The company is in charge of purchasing and preparing land to sell to homebuilders such as D.R. Horton (DHI). With that, the company can take advantage of inflation by increasing their prices, and is able to do so because land for homes is in short supply in some parts of the nation. In fact, FOR has a significant symbiotic relationship with DHI to provide homesites to the builder, and in turn, FOR has a stable revenue source. While one can consider both stocks as an opportunity, I find FOR has slight advantages that may allow investors to have more safety. Have you taken steps to increase your inflation fighting capabilities? Let me know in the comments!

Forestar

Historical Inflation And Housing Data

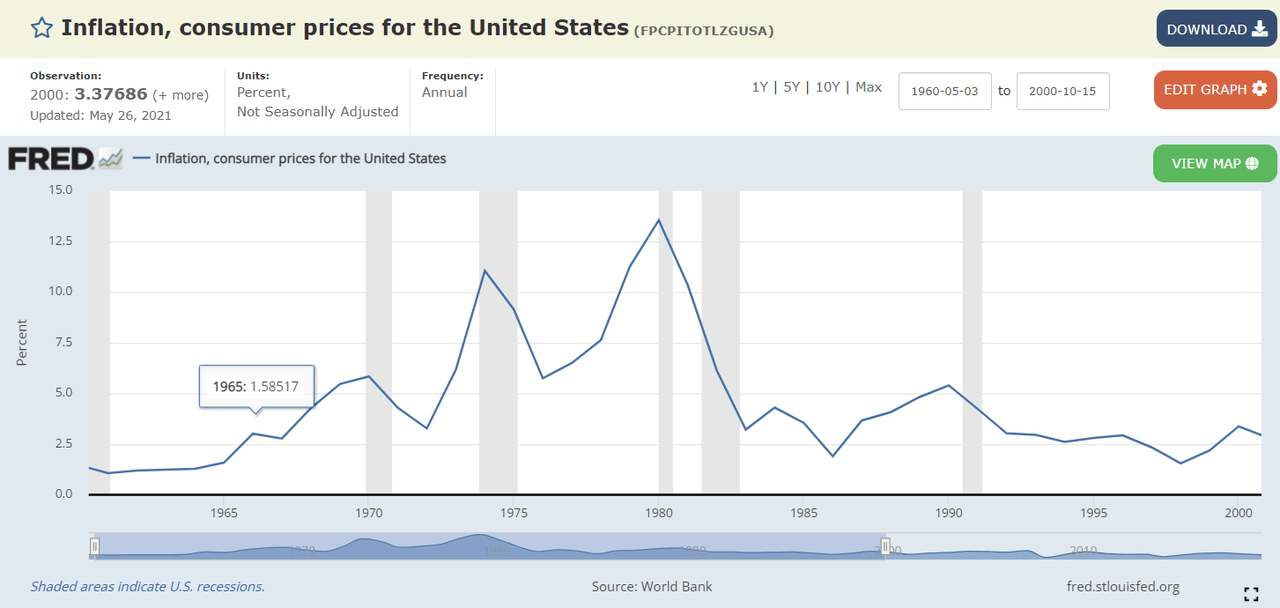

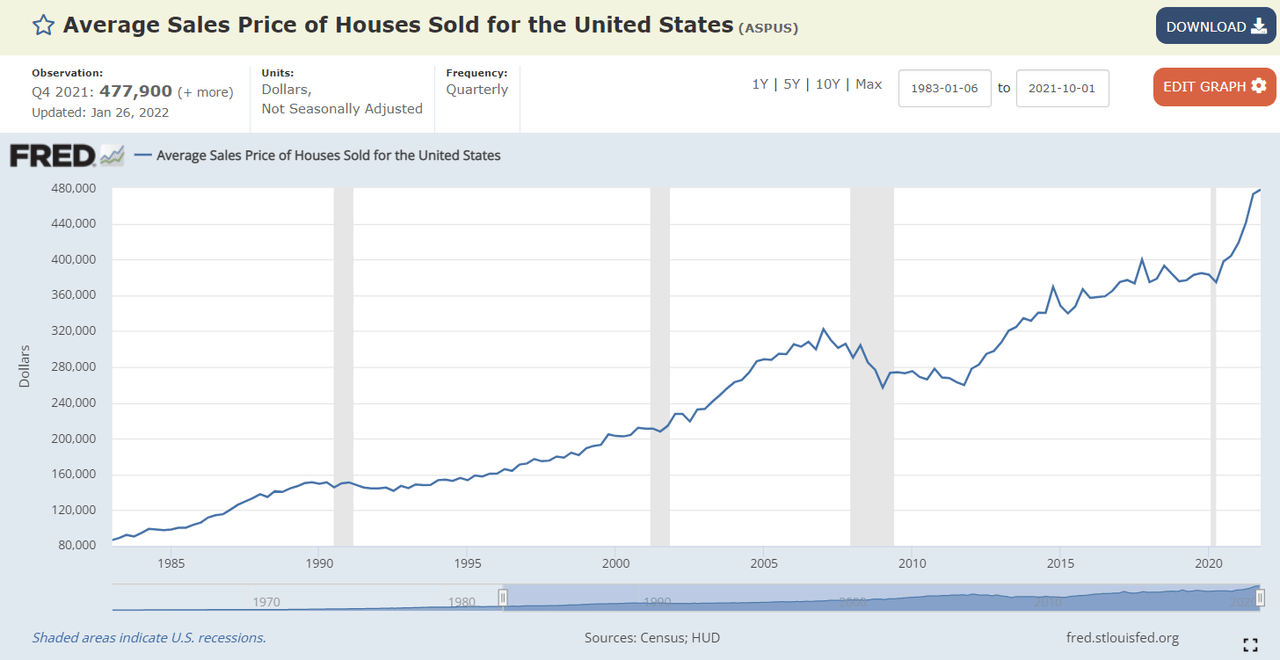

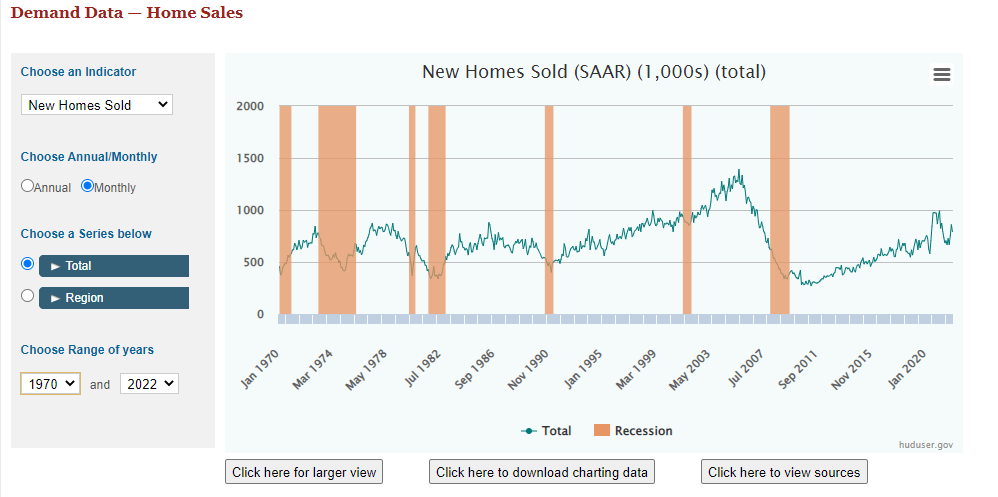

Let us start by understanding what data points we can use to feel comfortable in investing during a high inflation period. Many investors are familiar with the high inflation period between 1965 and 1985, and this is the major time period we can look at. While there are differences in calculating inflation between that period and today, it is safe to assume inflation is high for both periods.

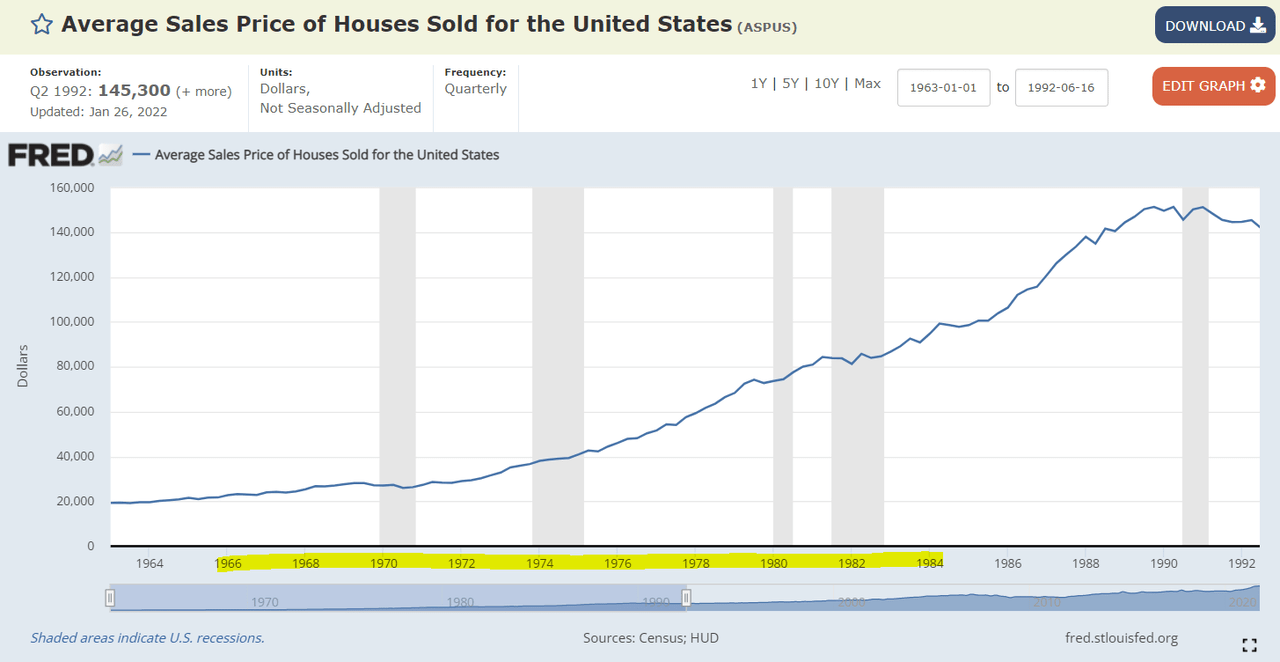

During the same time period, house prices increased significantly as well. However, I believe the takeaway is that housing prices and values remained growing even after inflation calmed. Further, during recessionary periods within a high inflation environment, housing prices failed to see significant drops. Therefore, the housing market remained strong during that period, and this is strong historical support. Why is this the case? Because inflation has almost always remained positive.

FRED FRED

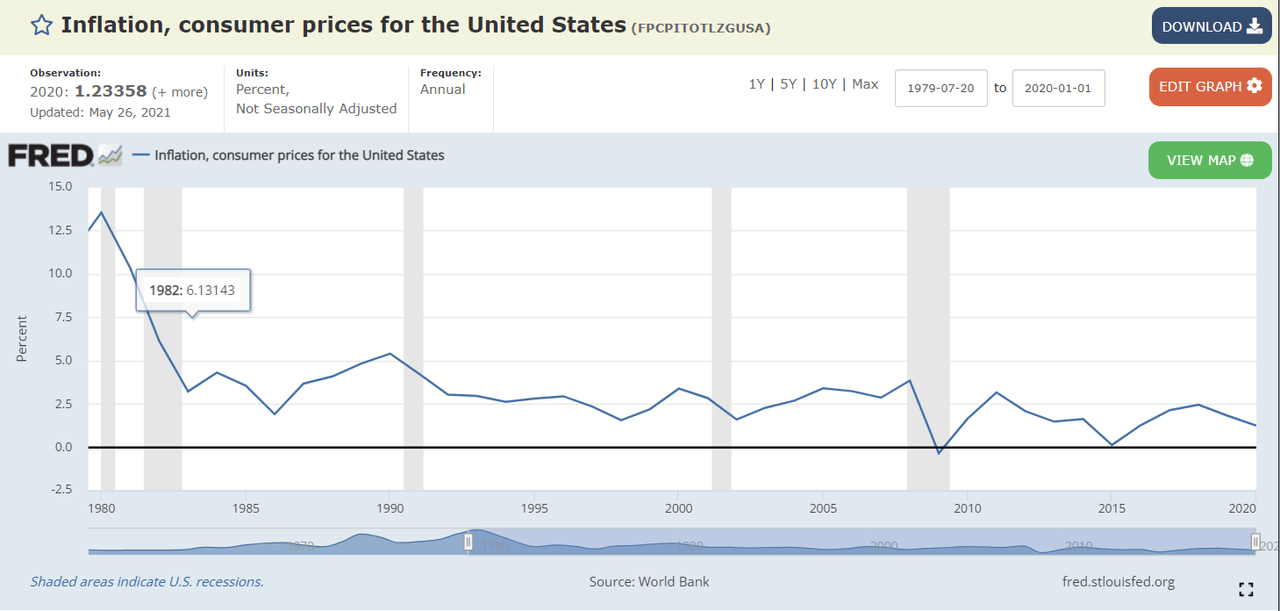

Additionally, we can look at inflationary periods more recently to determine if the pattern of the 20th century remains intact. Moving forward, we can start to see more influence from falling inflation. During the period of high inflation from ‘85 to ‘90, housing prices rose significantly, but plateaued between ‘90 and ‘95. Another period of high inflation between 2002 and 2008 also coincided with a steep increase in housing prices.

The only signal that we have that leads to falling housing prices is during the Great Financial Crisis when inflation fell below 0%. The nature of that event is quite specific, and I believe that the factors that led to that event, and subsequent regulatory fixes reduce the risk of a similar event significantly. Further, there is no deflationary pressure at the moment as inflation remains at close to all-time highs (not available via FRED data yet). Do note how housing prices began to fall prior to the GFC deflation as well, so outside factors were far more influential. For investors, it will be important to watch if sales decline as a rebound off the ultra-demand in 2020-21.

Recently, additional support for continued housing price growth is the pattern during the low inflation period around 2015. We can see that in 2015, and other low inflation points, the peak in housing prices occurs up to a few years after lowered inflation. Therefore, we can assume that due to the current phase of high inflation for 2021 and 2022, housing prices will continue to trend upwards for at least the next year or so.

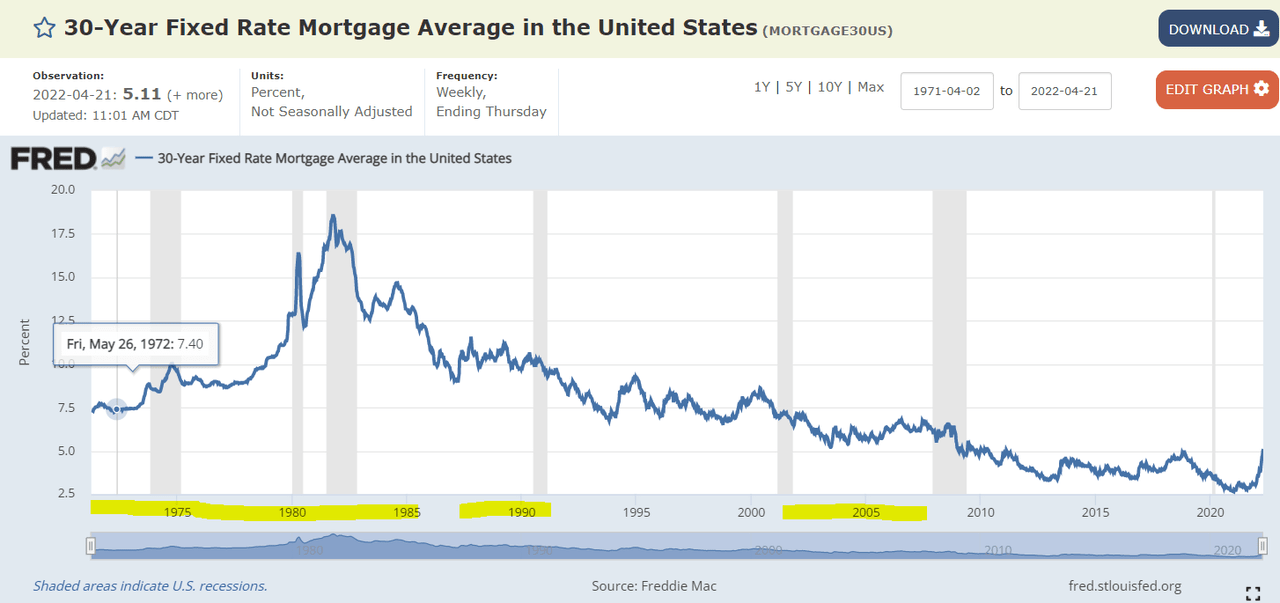

FRED FRED

The data seems to be favorable to ever-rising home prices, and those interrelated industries. However, other factors such as mortgage rates may be another important indicator to consider. Fortunately, we can see that there is little multi-year correlation between the current rising mortgage rate environment and the risk for falling house prices. In fact, we can see that when mortgage rates are increasing, housing prices are also in a strong upward trend, such as in the 70s to early 80s, 2000s until the GFC, and even the 2010s. Therefore, we can assume that even if mortgage rates increase, there is little support in the historical data that home prices will fall. In fact, the only risks are sentiment, valuation, and the unknown of fiscal-political policy, which typically just offer short-term advantages for those who are lucky.

FRED

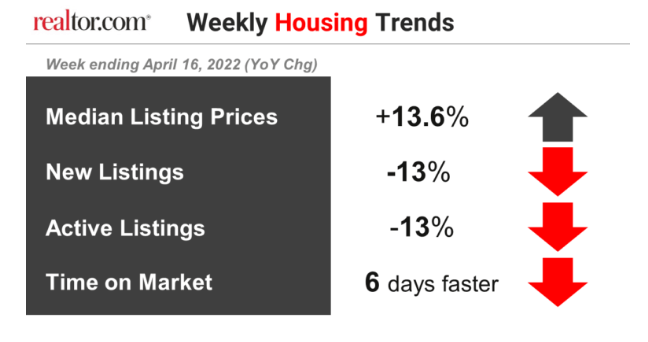

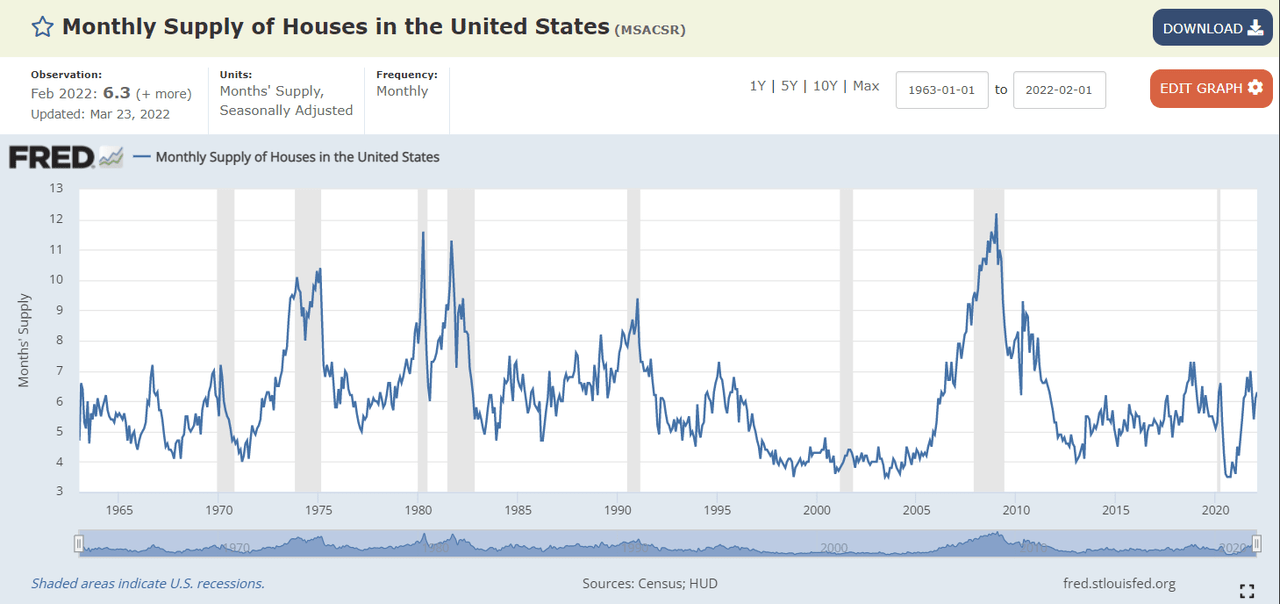

Housing Remains In Short Supply, Prices Increasing

According to Realtor.com, housing prices continue to climb in April 2022, up 13.3% YoY. At the same time, supply is falling as new and active listings fell 13% each. This data was also true for California for Feb/March, and I provide more details on the housing market in my article on Five Point Holdings (FPH). In that article, I came to the conclusion that housing prices are likely to continue rising and offer revenue and valuation growth for real estate related companies. However, supply is far greater in 2022 than in 2020 and early 2021, and has returned into an average range. This increases risk of reduced demand and falling prices. Although, this is nowhere near 2000s levels.

Also, developers that are able to produce high-quality assets in high-quality areas are also able to negate the effects of excess supply or low demand. I suspect that any decline in YoY housing price over the next few months may lead to a sell-off, but unjustly so. Looking at the data, nothing too significant is showing yet, but it will be important to watch the data.

Realtor.com FRED

US-DHUD

Forestar Asset Summary

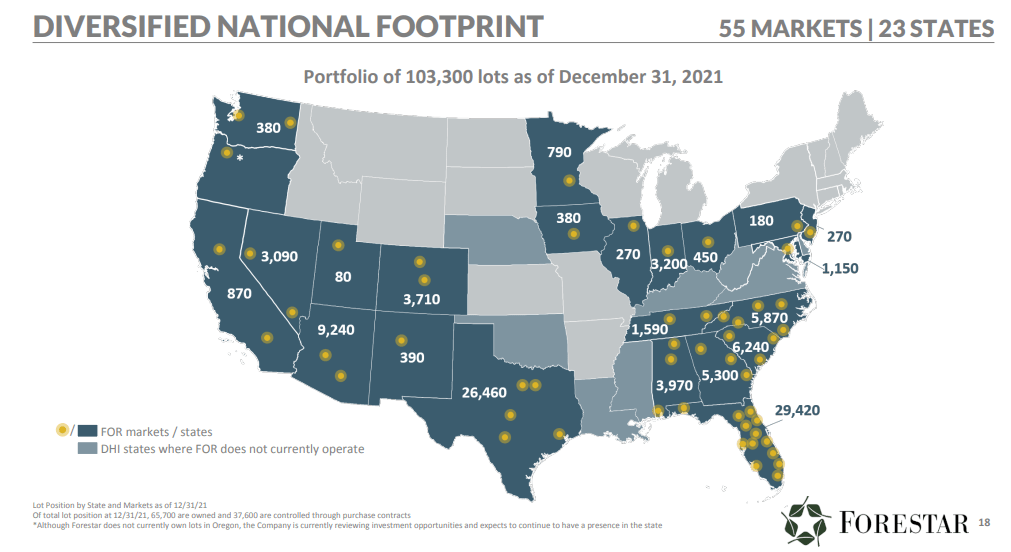

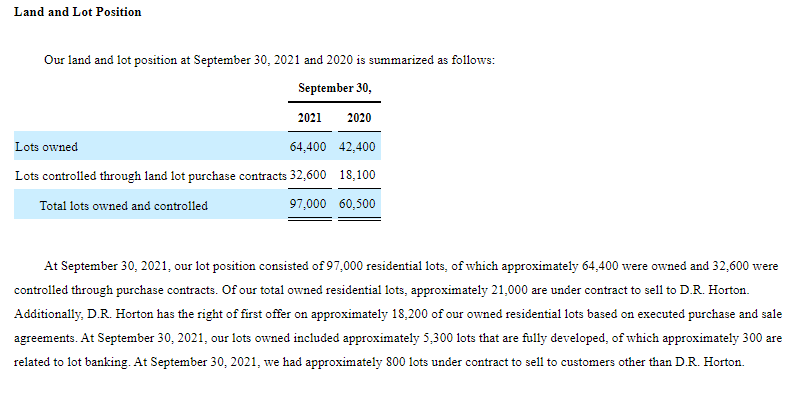

Now, we must take a look at FOR’s assets to see if we can find information on strengths and weaknesses in the company’s particular markets. Fortunately, the company is quite diversified across the US with over 200 projects, and no individual assets will weigh heavily on the company. Florida and Texas are by far the largest states with 29.4 and 26.5k lots, respectively. Then Arizona, South Carolina, and North Carolina round out the top five with between 5.9k and 9.2k lots each. The company is located primarily along the Sunbelt, the area of the US that typically offers the highest population, wage, and housing cost growth.

Forestar Forestar FOR 10-k

Financial Summary

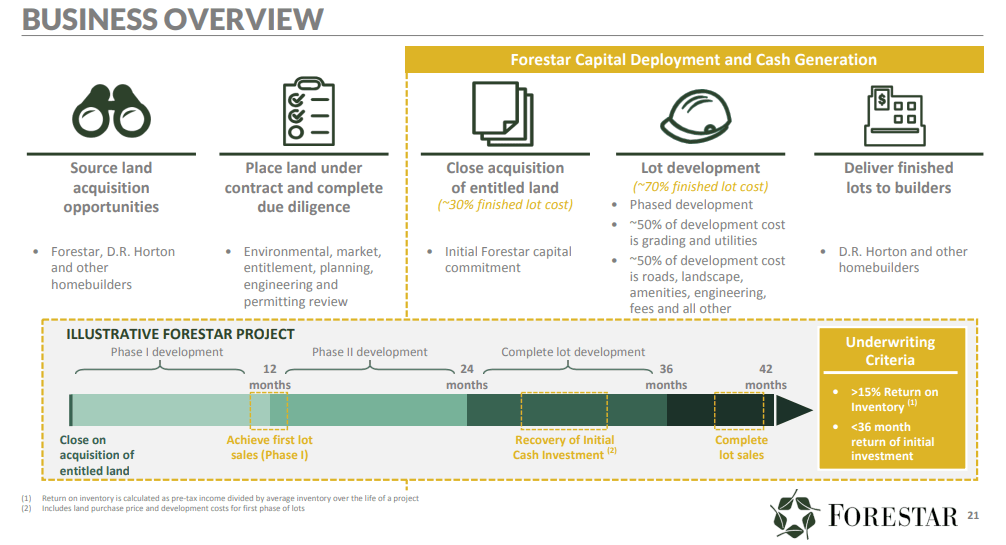

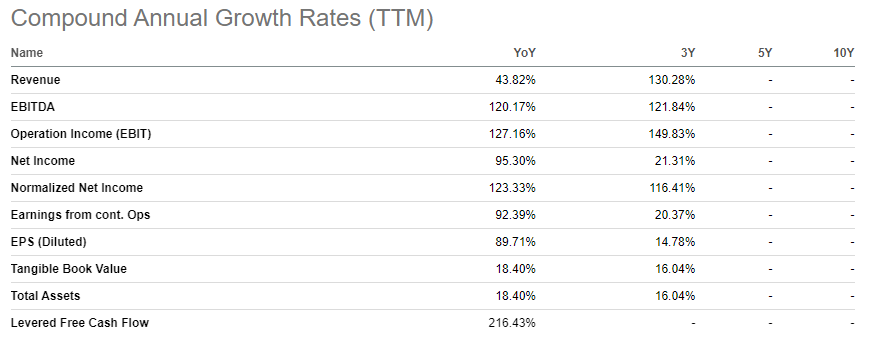

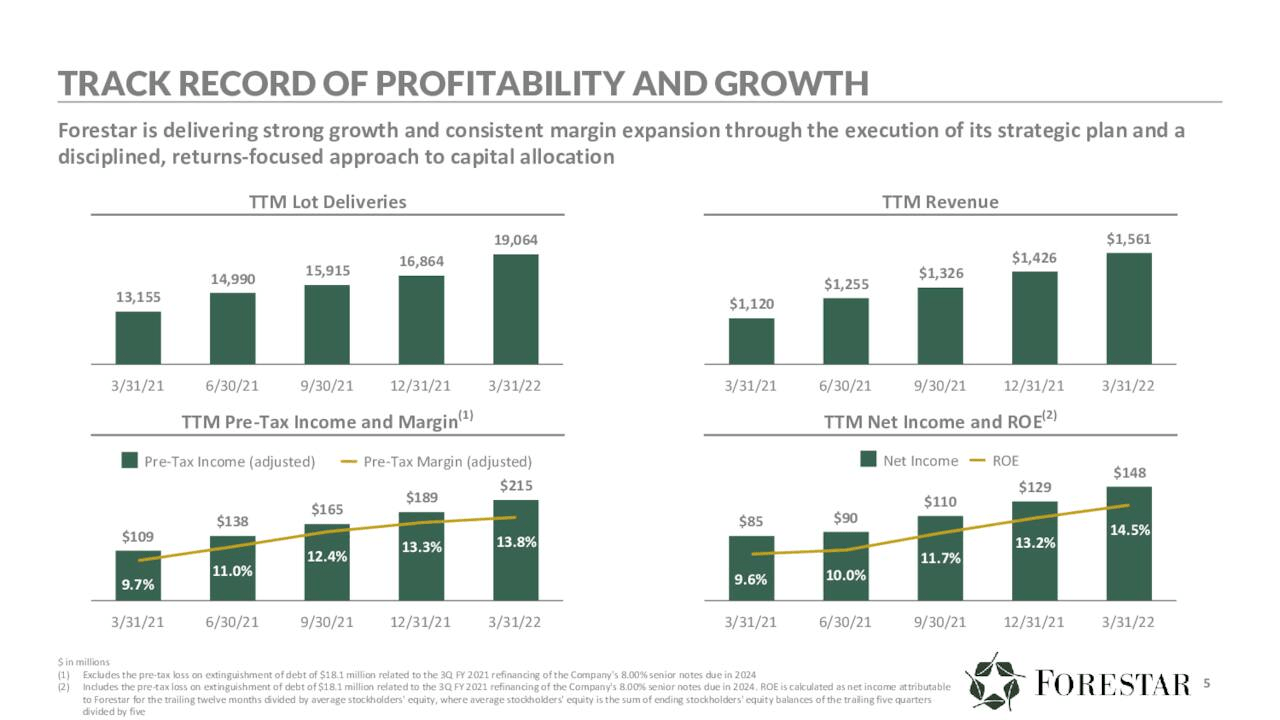

Forestar is a land development company, and this means that they source the desired open lots, perform all necessary procedures to begin development, and finally prepare the individual home sites for builders. In 2021 (year ended Sept 30), the company sold 14,221 developed projects and 1,694 lot banking (investment) projects, and the total of 15,915 is an increase of 53% YoY. Meanwhile, full year revenues grew 42.3% YoY to reach $1.33 billion. The reduced revenue growth can be attributed to lower price per lot metrics (to $81.6k last year from $84.6k in 2020) because of a larger portion of lot banking projects sold in 2020.

Seeking Alpha

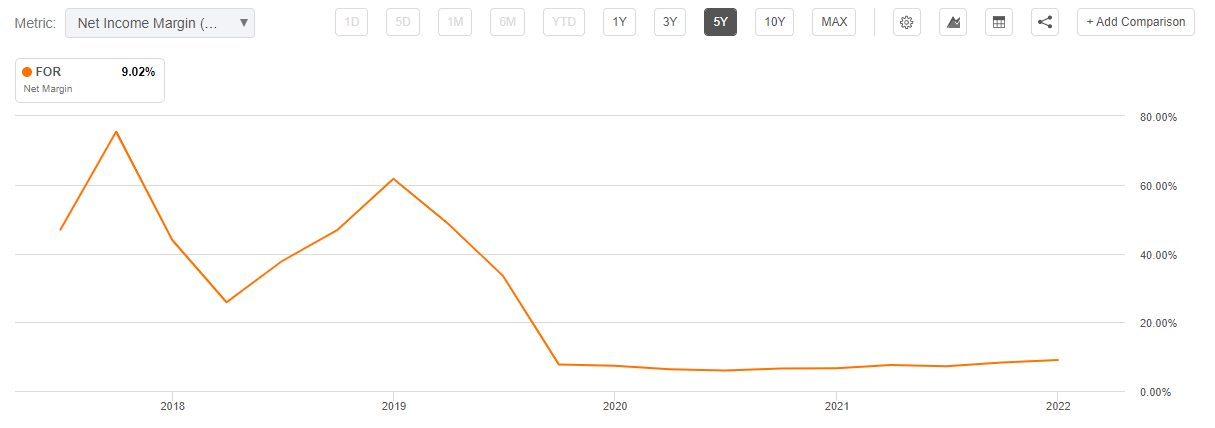

Net income is positive for the company, and has been growing consistently since 2019. In the past, only one year out of the past 10 saw negative net income. For 2021, FOR brought in $110.2 million in net income, an increase of 82% per year since 2019. This corresponds to a 9.0% net income margin that is flat since the end of 2020. Longer horizons charts show how prior to 2019, the company focused on profitability over growth, but this strategy has since changed.

Seeking Alpha

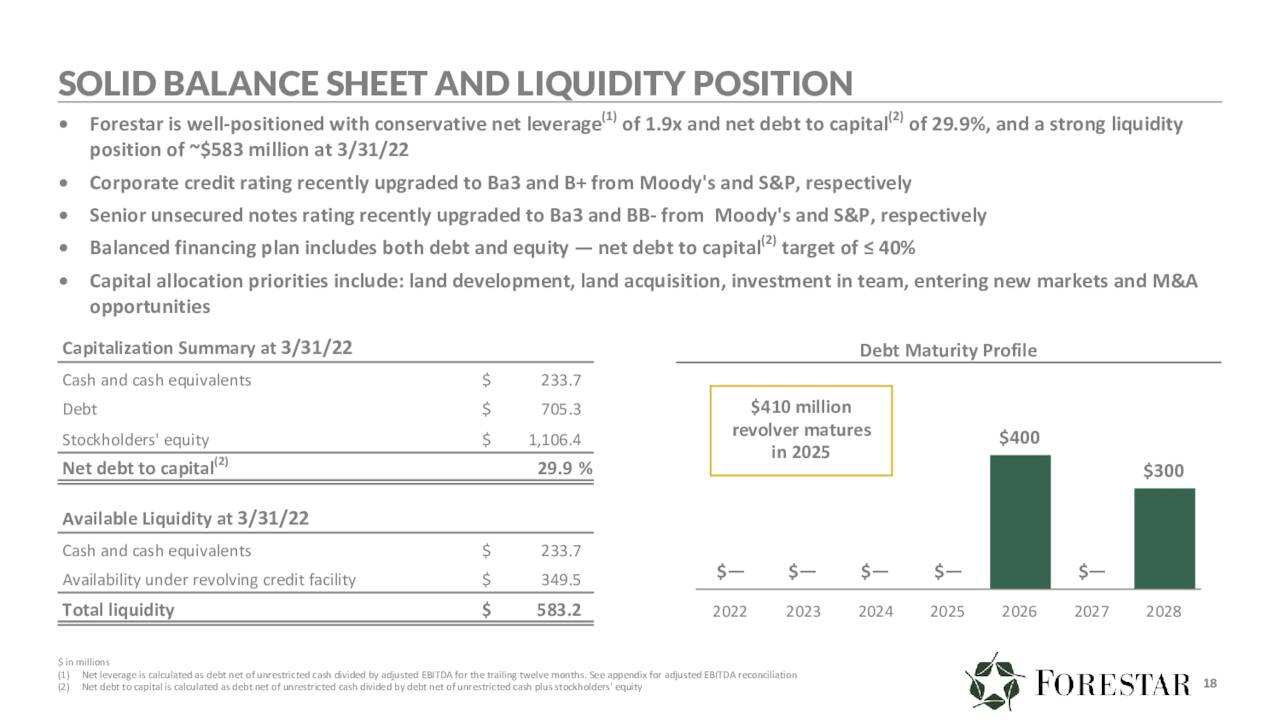

Lastly, we can look at the Forestar’s balance sheet. Leverage is currently the biggest issue, with the company holding on to $700 million in total debt. $300 million of this is in the form of 5.0% senior notes due in 2028, while the other $400 million is in the form of 3.85% senior notes due in 2026 which favorably redeemed 8.0% senior notes. While leverage is high, rapidly increasing earnings offer safety over the next few years, and the significant lot holdings offer a few years’ worth of solid transparency. Therefore, I find the risk level tolerable in regards to the balance sheet, but would always look at debt reduction favorably.

Forestar Forestar

D.R. Horton: Majority Shareholder

One major point investors must consider is that FOR is majority-owned by D.R Horton. Is having the largest land developer in the US as stock-controller a curse or a blessing for shareholder interests? Considering DHI requires significant homesite supply for their own growth, and the partnership with Forestar being a major source, I see the relationship as more symbiotic than predatory. The two companies work together to source development lots, and in turn, DHI retains the rights to purchase up to 100% of those corresponding lots. Additionally, up to 50% of the land that Forestar sources on its own is first rights for DHI. Third-party development is not affected.

There are special rules and regulations in regards to this special “controlled” status that FOR must follow. This included the need to find DHI permission for practices such as issuing equity, increasing debt to over 40% gross leverage, and even making an acquisition or investment greater than $20 million. Therefore, we must consider whether DHI can be considered a viable management company. To do so, I will provide some summaries provided by ratings providers that highlight DHI as a well-managed company. In essence, for a cyclical industry, DHI is conservative and well-aligned for stable growth into the future. As such, the favorable relationship allows FOR to have a premier revenue source so that investors can sleep well at night.

Fitch

Moody’s

Incredibly Fair Valuation

As my last data point, I will use the current valuation as further support for Forestar’s viability over the next few years. The company is currently at a trailing 4.9x P/E (Non-GAAP) and 0.58 P/S. These values are both at 3 Year lows, even considering the COVID crash two years ago. In fact, the stock is not rising after the favorable earnings report on Thursday the 21st of April, 2022. The favorable valuation may be due to their new relationship with DHI, and subsequent growth, as being unseen by the market. Also, the whole homebuilding market has performed quite poorly over the last year and a half or so. This negative sentiment, and below…

Read More: Forestar: A Top Inflation-Fighting Stock (NYSE:FOR)