franckreporter/iStock via Getty Images

Wall Street resumed its downward momentum on Tuesday, as a route in consumer and technology shares once again sent the major U.S. equity averages to their lowest levels since mid-March.

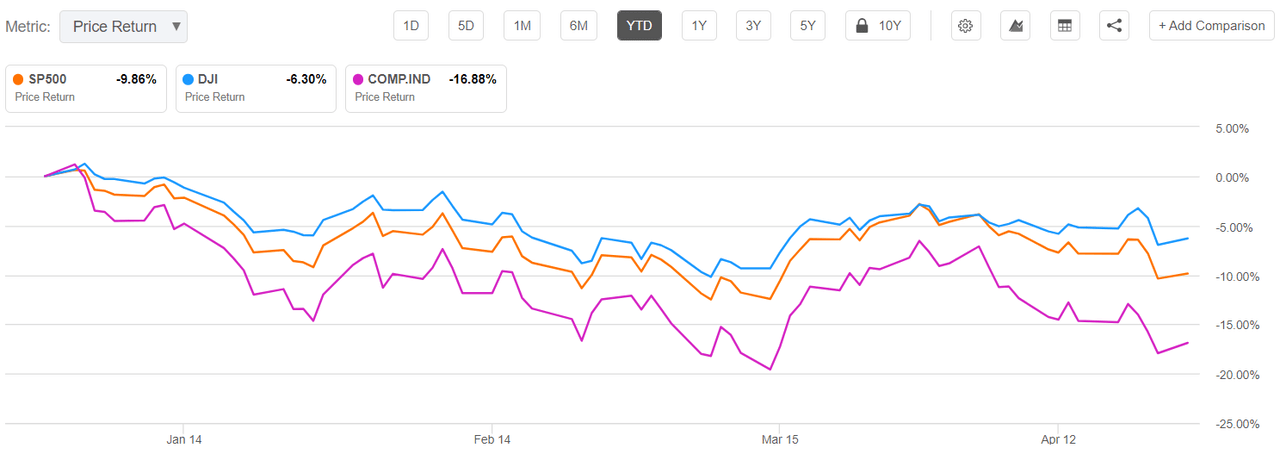

The Nasdaq led the retreat, showing a midday performance of -3.2%. Meanwhile, the Dow Jones (DJI) was 1.8% and the S&P 500 (SP500) was -2.1%.

Ten of the 11 S&P sectors showed weakness in midday trading. This was led by a nearly 4% slide in Consumer Discretionary and a 2.6% fall in Communication Services. Energy represented the only segment sitting in the green.

Megacaps traded well into the red as well. Tesla (TSLA) provided the vanguard of this retreat, with the EV maker lower by 11%.

Turning to the bond market, Treasury yields cooled off during the session, as the U.S. 10-year yield was down seven basis points down to 2.76%. The U.S. 2-year yield was off as well, falling 10 basis points to 2.53%.

At the same time, the DXY, an index tracking the U.S. dollar, surpassed $102. This marked its highest level in over two years, dating back to the beginning of the pandemic, Mar. 24, 2020.

Oil prices also shifted upwards. WTI crude broke back above the $100 per barrel marker, climbing about 4% in midday trading to reach a level around $102.50.

In economic news, durable goods orders in the U.S. came in at 0.8% in Mar. of 2022, slightly below the consensus of 1%. The numbers were an increase from the previous month’s -1.7%.

As earnings season forges forward, GE (GE), JetBlue (JBLU) and UPS (UPS) were among the big names that reported earnings earlier in the day.

“The next two weeks mark the heart of earnings season, with 337 companies scheduled to report. We believe earnings will continue to handsomely top estimates. While investors might be distracted over the near term, eventually fundamentals should prevail.” Credit Suisse stated in a recent note.

Kit Juckes of Societe Generale stated: “Pressure was building into the weekend, but yesterday morning’s stormy markets may have helped clear the air. The Chinese authorities seem to be trying to instill some stability into USD/CNY, bond yields have steadied for now and equity indices too, are finding a toehold.”

See below the YTD performance chart of the S&P 500, Dow Jones, and the Nasdaq Composite.

Read More: Nasdaq leads S&P 500 and Dow Jones lower as consumer, tech shares plunge