jaanalisette/iStock Editorial via Getty Images

Dear readers/followers,

My investments in growth stocks such as Twilio (NYSE:TWLO) have always been very moderate. Though I have a track record of providing actionable and profitable advice on such investments, such as my set of articles on Prosus (OTCPK:PROSY) and Adyen (OTCPK:ADYEY), I’ll be the first one to tell you that these stocks are not my focus.

Still, the view of a valuation-oriented dividend investor can be of value to some, if they’re on the fence about whether to invest in a business like TWLO.

This is my view on TWLO.

Twilio – The Business

I always try to simplify things as much as possible and will take the same tact here.

Twilio is a company in the business of offering so-called Cloud Communications as a Service, or CPaaS. As service-companies are growing, and Software-as-a-Service (SaaS) companies are just the beginning here.

The company offers solutions that customers can plug into their operations through so-called APIs, standing for Application Program Interface, a now-standardized way of transferring information.

The company connects traditional telco infrastructure (phone numbers, messaging, voice, connecting IoT to cell devices, email, video, live streaming) to the internet through the company’s so-called SuperNetwork, added by Channel APIs. These two areas are the essential foundation of all of Twilio’s products, with powerful APIs essentially on top of the foundational SuperNetwork infrastructure, consisting of over 1,500 carrier connections. Think of these two things as interconnected.

The company provides customers with a very modern and simple way to connect and communicate with their customers and within their own business. The company’s solutions are easily embeddable through the aforementioned APIs into both applications and websites as well as services such as SMS, emails, and chat functions.

Historically, Twilio started out prior to the financial crisis in 2008 as a VoiceCall company, allowing customers to make and receive cloud-based calls. Twilio SMS which was launched in 2009 became more successful, and since then the company has been on a mission to launch new products and services either through its own R&D or through M&As.

The company is global, with customers in over 180 countries. There is no company dividend. There is no S&P credit rating – though, at a high cash position and less than 10% debt/cap, it can be argued that TWLO has no need for something such as that at this point.

On a high level, you can view Twilio as a “cake” of service offerings. The base layer is the SuperNetwork, stacked on by Channel APIs that form the very core layers of the company.

Following these two, the company also offers the possibility to add Services. These services include things like verification/ID services, advanced messaging services, and other things.

As the top layer of the “cake”, the company offers very advanced higher-level solutions that sometimes act more as cloud-based software suites, such as Twilio Flex, which is a cloud center contact platform, allowing for cross-platform customer communication. It also offers integration with the most common CRMs. Aside from this, Twilio also wants to offer Marketing/Campaign management.

In addition to this, viewing the top layer, Twilio has done multiple interesting M&As over the past few years with capacities that have been inserted into the company’s capacities. The biggest is probably Segment, which allows Twilio to be used to create incredibly personal advertisement/marketing campaigns, thanks to class-leading individualized data collection across multiple devices and sources. This is what drove the creation of Twilio Engage, through which customers are able to be targeted with individualized engagement regardless of customer stage.

The ultimate target of this is, of course, to drive repeat purchases, increase conversion and drive engagement across different digital channels.

The company also has a couple of other things in the pipe – but given the beta status of most of these, I don’t view them as worth going into at this point.

So – that’s Twilio in around 600 words, as I view the company. It provides customizable communication tools and engagement/analytics for B2C engagement.

The Value Proposition For A Company Like Twilio

There is no doubt in my mind that the company has a very comprehensive and appealing set of offerings to customers. You don’t build a business and get customers such as Airbnb (ABNB), DoorDash (DASH), MercadoLibre (MELI), Glassdoor, Shopify (SHOP), Lyft (LYFT), and other massive businesses without having appealing products.

The people who say that Twilio has no business or no moat, I say that this is completely untrue. The company has a solid business proposition, and it has a form of a moat.

I don’t agree, though, that Twilio is “without peers”. There may not be many companies, or indeed any that do all that Twilio does, but there are certainly competitors that do part of what Twilio does, to one degree or another. Competitors to Twilio include things like Vonage (VG), MessageBird, Plum Voice, Vidyo, and others – though again, most of these are only partially in the same businesses and services that Twilio is active in.

The company specifies a TAM of $4.6B, growing to around $22.4B by 2028 for cloud communications, and their total TAM to $79B, thanks to customer data expansion.

Specifically, the company believes that it can grow based on ongoing digital transformation and technology adaption/Direct-To-Consumer sales models – trends that obviously have been accelerating significantly during the pandemic. Everything that’s been focusing on at-home and digital delivery has been experiencing significant growth – and so tools that support this, such as Twilio, are growing as well. The company sees benefits from the pandemic due to helping businesses communicate, including from remote spaces.

Secondly, the company sees changes in data privacy with increased requirements for first-party data. Twilio, again, solves this issue through its Engage platform and its Segment M&A. This shift from what’s known as third-party data to first-party data is of a net benefit to every company that works as Twilio does.

Twilio’s Revenue & Profits

Based on these two or three trends as drivers, we can move on from here. In terms of revenue, Twilio generates revenue in one of two ways.

- Usage-based Fee business

- Monthly Subscription fees

None of these is especially strange, and we, as investors, can assume that Twilio has priced these various services at pricing points where, eventually, the company will make a net profit from its operations.

That’s revenue – the company’s COGS/Cost of revenue primarily comes from fees paid to network service providers based on the respective volumes of calls, services, and other things used.

It’s, therefore, possible to simplify that the company earns a small margin on the difference between fees paid and fees earned.

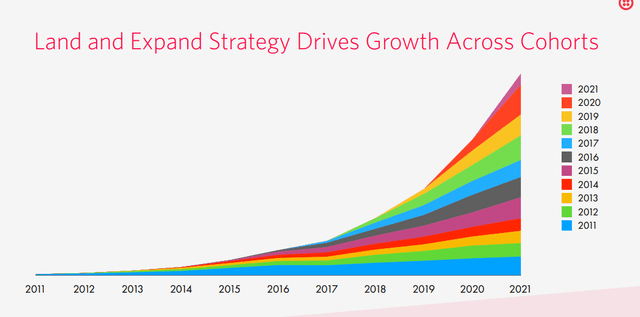

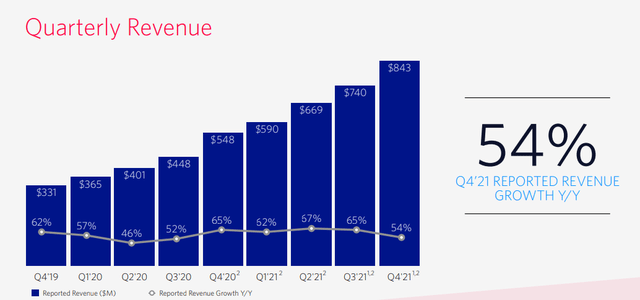

Overall, the company has been able to grow revenues at a relatively impressive rate – though the revenue growth rate has been dropping from 80-85% to below 60% YoY in the last couple of quarters. There have also been one-time effects such as elections, pandemic-fuelled digital adoption/growth, and other things. Revenue, simply put, has been solid for several years, and customer growth has been solid as well – even if customer growth rates have dropped off from 20-24% to less than 17% as of the last quarter reported.

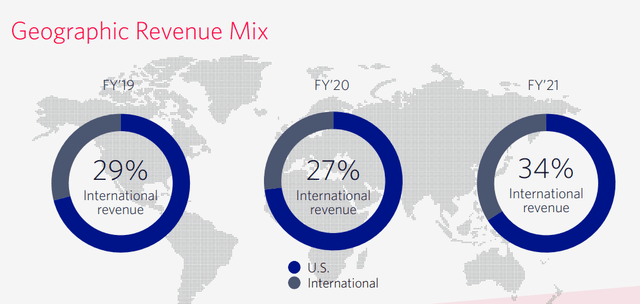

The company has fairly solid gross margins, coming in at 50-55% and dropping below 50% only during the last two quarters or so. The reason for the ongoing gross margin decline is higher fees by certain carriers and overall higher service provider fees, as well as international expansion, with international margins being lower than US-based margins.

As I mentioned, Twilio’s earnings are a product of the difference between fees paid and fees earned (grossly simplified) – and since the company doesn’t control the cost side of that equation, and might not have the pricing power to push prices upward all that far, this can potentially hurt margins.

I like numbers. Numbers don’t lie. We do need to understand them, but they don’t lie.

And unfortunately for Twilio, their numbers aren’t looking all that stellar.

While Revenue growth has been solid, and the company’s so-called Dollar Based Net Expansion Rate, or DBNER (measuring the percentage of increase in revenue on a per-customer YoY basis) has been strong, there are some things to understand here.

The first and most obvious problem is that Twilio is not a profitable business. By that, I mean that its net profit is negative, and these net profit/GAAP profit numbers have actually worsened for years, despite continued growth in revenues. From early 1Q19 to 4Q21, we’ve gone from close to negative $0.5 EPS to negative $1.5 – and less. The FY21 net profit came in at a negative $5.45. The company also does not expect this to materially change in 2022.

Even on a Non-GAAP/Adjusted basis, the company’s earnings are in negative territory. The company predicts to achieve continued revenue growth and some stellar, 60% non-GAAP GM levels, but given that all of the company forecasts are non-GAAP, they are of limited interest to me.

Right now, management expects to turn profitable (albeit on a non-GAAP basis) by 2023.

The company’s cash-rich position, pointed to by some investors and bulls, isn’t something I focus that much on since it’s mostly a result of debt and equity, not operational cash flow. While management is to be applauded for timing, I’m not one to applaud a rich balance sheet that’s being filled like this, even if it does mean they can pursue further M&As. A good point about TWLO is that they’re at least not burning through that cash from its operations – but are mostly “neutral” in terms of…

Read More: Twilio – A Future Essential, Or Overhyped & Just Unprofitable? (NYSE:TWLO)