ClaudioVentrella/iStock via Getty Images BioMarin

The ability to see through some majority opinions to find what facts are really there is a trait that can bring rich rewards in the field of common stocks – Philip Fisher (Warren Buffet’s mentor)

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on May 06, 2022.

As you notice, I typically research/write much more during a bearish cycle. After all, there are plenty of intriguing investment opportunities in a down market. That is to say, it is much easier to find bargain growth stocks when investors are exiting the market en masse. Going against conventional wisdom to find buying opportunities (and overcoming your fear to purchase) is the key to enjoying substantial profits in the long haul.

That being said, I recently assessed the investing thesis of BioMarin Pharmaceutical Inc. (NASDAQ:BMRN). And, I’m quite intrigued by this growth/value equity. As BioMarin has already appreciated to $15.1B in market capitalization, I would classify it as a “stalwart.” Still growing, yet not as fast as a young grower, a stalwart typically gives your portfolio less than 50% upsides while conferring it with more stability. Putting it another way, a stalwart is a good “portfolio anchor.” In this research, I’ll feature a fundamental analysis of BioMarin and share with you my expectation on this interesting stalwart equity.

Figure 1: BioMarin chart

About The Company

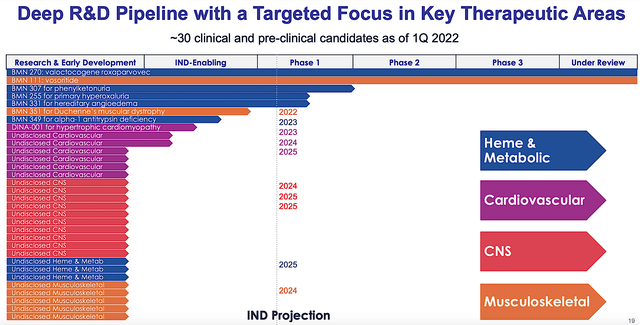

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm I recommend that you skip to the next section. Operating out of San Rafael, California, BioMarin is focused on the innovation and commercialization of novel therapeutics to fulfill the unmet needs of orphan diseases. Viewing the figure below, you can see that BioMarin is assessing various molecules for different therapeutic areas including, heme/metabolic, cardiovascular, CNS, and musculoskeletal. Hence, the early developmental efforts here can generate massive growth in the coming years.

Figure 2: Developmental pipeline

Commercialized Therapeutics

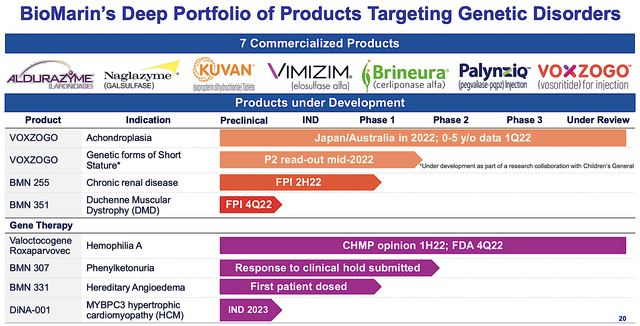

Asides from the breadth of innovation, BioMarin is already garnering much success with its approved medicines. You can see from the figure below that there are seven commercialized drugs for various genetic disorders. As enzyme replacement therapy for various rare genetic diseases, they entail laronidase (Aldurazyme), galsufase (Naglazyme), saproterin (Kuvan), elosulfase (Vimizim), pegvaliase-pqpz (Palynziq), cerliponase (Brineura), and vosoritide (Voxzogo).

Figure 3: Commercialized therapeutics

Increasing Revenue Across Broad Customer Base

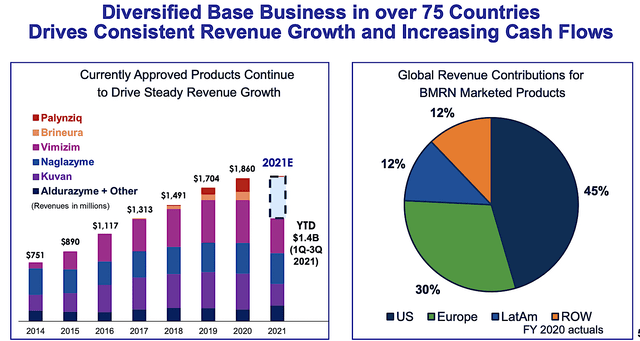

As you can imagine, I like BioMarin because the approved products are generating significant sales while having a strong growth trajectory. From the figure below, you can see that the approved drugs are posting increasing year-over-year (YOY) sales growth since 2014.

Just as important as the growth trend, BioMarin’s revenues are distributed across 75 countries. As my general rule-of-thumb, the more customer bases a company can spread out, the lesser the risk of having one or a few clients significantly affecting your earnings.

Figure 4: Diversified and consistent growth

Orphan Disease Focus

Shifting gears, let us analyze BioMarin’s focus on orphan diseases. If you’ve been following my research, you can see that I ascribed high value to orphan (i.e., rare) disease innovation. That is to say, these conditions have a prevalence of less than 200K in the U.S.A.

In riding the orphan disease niche, it made sense that BioMarin is able to catapult its product sales over the years. Of note, orphan disease innovation is looked upon favorably because it fosters development in an area that is in dire need of advancement.

As a ramification, the average reimbursement for rare diseases is approximately $140K annually. You may not agree with me but innovators have to be rewarded adequately for the costly/lengthy development process. After all, no company would want to spend roughly a billion dollars in a 7-10 years-long process only to suffer losses in commercialization.

Aggressive Label And Geographic Expansions

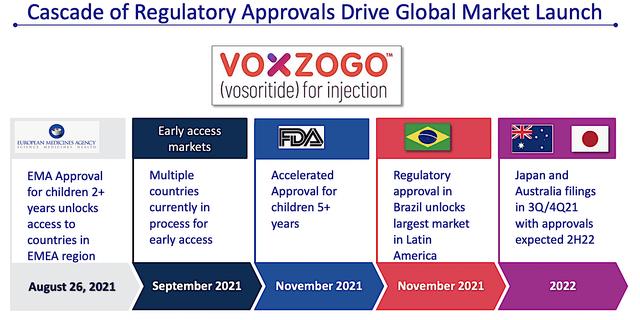

Asides from the orphan disease focus, I like BioMarin’s aggressive label and geographical expansions for its approved molecules. For instance, Voxzogo is already FDA-approved for the treatment of children suffering from achondroplasia (i.e., for those aged 5 and up whose growth plates are still open). As depicted below, BioMarin is growing its geographic footprints globally to maximize market penetration. With additional market launches, you can expect leaping growth in revenue.

Figure 5: Accelerated approval and expansion

Interestingly, BioMarin is also expanding Voxzogo’s label for genetic forms of short stature. Therefore, the additional labels confer a lower risk of development. It’s just like a tree growing by forming additional branches is much easier than planting a new tree. Simply put, it’s more strategic to pick the low-hanging fruits.

When you couple the orphan disease focus with the aggressive label/geographical expansion for the approved medicines, BioMarin would become a special long-term investment. And, if you keep your shares for the ultra-long-haul, they’ll most likely handsomely reward you.

Operational Highlights

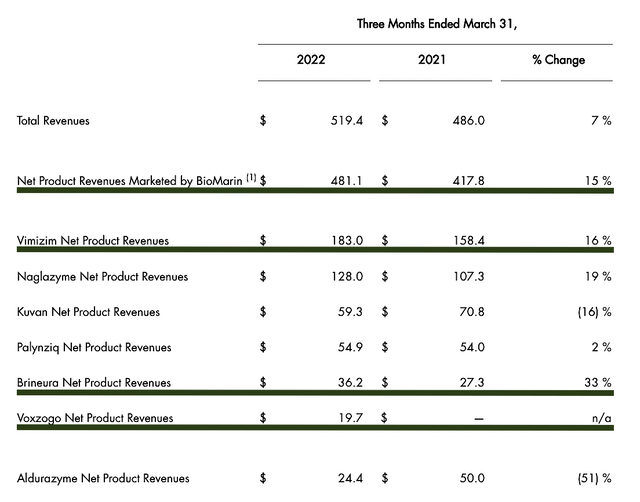

As you already see the general trend and the underlying thesis, let us dig deeper into the latest quarterly results (i.e., 1Q2022). From the figure below, you can see that the total revenues increased from $486.0M to $519.4M (i.e., going from 1Q2021 to 1Q2022). Therefore, it represents a 7% YOY growth rate.

Figure 6: Robust sales growth

Of specific launched medicines, Vimizim registered $183.0M out of the $481.1M total revenue. Hence, it accounts for 38% of total sales. Interestingly, the drug is still growing at a remarkable 16% rate. Despite that it only procured $36.2M, Brineura enjoyed the fastest growth rate at 33%. As to Voxzogo, I believe that the various geographical expansion would quickly ramp up sales in the coming quarters. Commenting on recent developments, the Chairman and CEO (Jacques Bienaimé) remarked:

We begin 2022 from a position of financial strength including significant contributions from our newest product, Voxzogo, the only approved therapy for children with achondroplasia … As we stated last quarter, in 2022 we expect to return to double-digit revenue growth and profitability. We begin the journey with record Q1 revenues, and foresee continued momentum based on the essential nature of our innovative medicines for our patients around the world. The regulatory team has been working collaboratively with the EMA as we near the completion of the application review procedure for potential approval of valoctocogene roxaparvovec gene therapy for the treatment of severe hemophilia A. We remain encouraged by the potential benefit of valoctocogene for people with severe hemophilia A based on the clinically meaningful study results to date. These demonstrate an 85% reduction in annualized bleeding rates compared to baseline using standard of care. With potential approvals of valoctocogene in Europe/USA, the continued strong launch of Voxzogo and our anticipated transition to sustainable profitability, we believe 2022 will be a transformational year for all BioMarin stakeholders.

Competitor Landscape

About competition, BioMarin’s drugs are competing against other enzyme replacement therapies (i.e., ERTs) that is the standard of care for these diseases. Examples of orphan disease innovators making such enzymes are Sanofi Genzyme (SNY), Amicus Therapeutics (FOLD), Protalix Biotherapeutics (PLX), etc. Despite the competition, there is plenty of space in the orphan sector for multiple blockbusters. Moreover, the competitive pressure is not as intense as in the other biotech sub-sectors like oncology.

| Drugs | Orphan conditions |

| laronidase (Aldurazyme) | Mucopolysaccharidosis (i.e., MPS) |

| galsufase (Naglazyme) | MPS VI (Maroteaux-Lamy syndrome) |

| saproterin (Kuvan) | Phenylketonuria (PKU) |

| elosulfase (Vimizim) | Morquio syndrome |

| pegvaliase-pqpz (Palynziq) | Phenylketonuria |

| vosoritide (Voxzogo) | Achondroplasia |

| cerliponase (Brineura) | Batten disease |

Figure 7: Various orphan conditions

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q2021 earnings report for the period that ended on December 31.

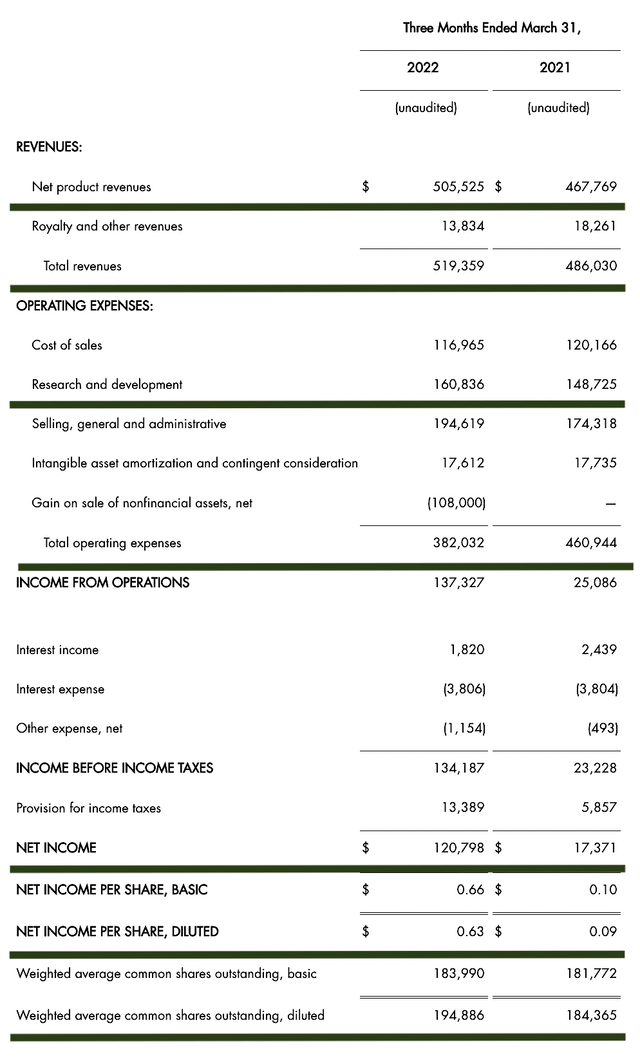

As follows, BioMarin procured $519.3M in revenue compared to $486.0M for the same quarter a year prior. Of that figure, the product revenue accounts for the $505.5M and $467.7M, respectively. On a year-over-year (YOY) basis, the product revenues account for an 8.0% increase.

That aside, the research and development (R&D) registered at $160.6M and $149.7M for the respective quarters. I viewed the 7.3% R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $120.7M ($0.63 per share) versus $17.3M ($0.09 per share) in net income for the same comparison. Keep in mind that the strong net gain for this quarter was due to the $89.0M earned in selling the Rare Pediatric Disease Priority Review Voucher (PRV) associated with the Voxzogo FDA approval. Concurrently, BioMarin is increasing its profitability.

Figure 8: Key financial metrics

About the balance sheet, there were $605.4M in cash, equivalents, and investments. On top of the $519.3M recurring revenues (and against the $382.0M quarterly OpEx), there should be adequate capital to fund ongoing operations without concerns for cash…

Read More: BioMarin Stock: A Good Anchor For Your Biotech Portfolio (NASDAQ:BMRN)