Lemon_tm/iStock via Getty Images

In falling equity markets, we like to look for stocks that outperform but also have a solid performance during regular trading hours. This shows increased interest by investors and institutions when liquidity is higher. Below is a list of 20 such stocks from the S&P 500 index (SPX).

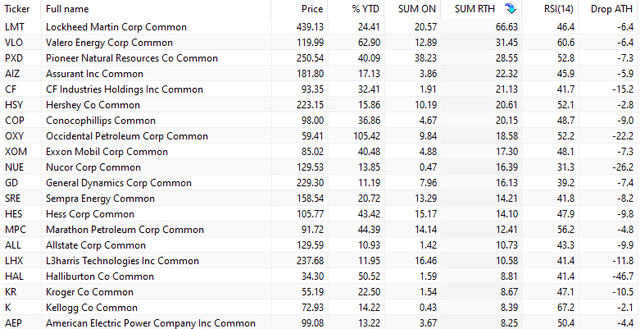

S&P 500 That Are Up Year-To-Date and Also Have Positive Performance in Both Regular Trading Hours and Overnight (Price Action Lab Blog – Norgate Data)

The above table includes stocks with positive year-to-date returns (as of May 10, 2022), and also positive regular trading hours (SUM RTH), and overnight accumulation (SUM ON). The regular trading hours accumulation is calculated as the sum of daily changes from the open to the close of a day and the overnight accumulation is calculated as the sum of the changes from the close of a day to the open of the next day. These are reported as point accumulations.

Eleven of the 20 stocks are in the energy sector, and since this is the sector that has outperformed year-to-date, we will focus on four stocks from the remaining nine of the other sectors.

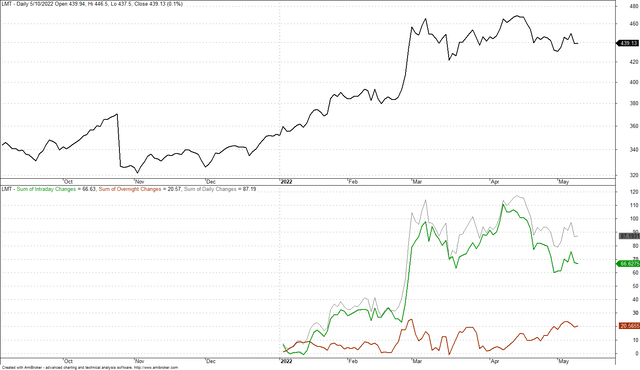

Lockheed Martin Corporation (LMT)

Daily Chart of LMT with RTH and ON Changes (Price Action Lab Blog – Norgate Data)

The chart of daily LMT prices shows the regular trading hours accumulation ($66.63), the overnight accumulation ($20.57), and the daily accumulation of $87.19, year-to-date.

There has been solid regular trading hours activity but also activity during the overnight. The stock is up 24.4% year-to-date and has been in a consolidation phase since mid-March. There are good odds for another uptrend in LMT after the consolidation. A fall below $420 could indicate a reversal to the downside.

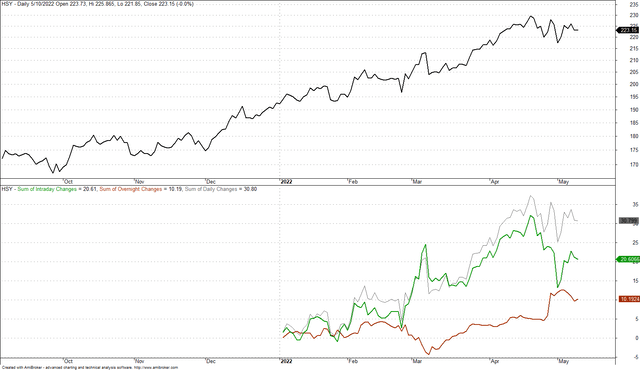

The Hershey Company (HSY)

Daily Chart of HSY with RTH and ON Changes (Price Action Lab Blog – Norgate Data)

The chart of daily HSY prices shows the regular trading hours accumulation ($20.61), the overnight accumulation ($10.19), and the daily accumulation of $30.8, year-to-date.

Regular trading hours activity has subsided since mid-April but it’s still solid. The stock is up 15.9% year-to-date and has been in a consolidation phase since mid-April. There are good odds for another uptrend in HSY after the consolidation. A fall below $216 could indicate a reversal to the downside.

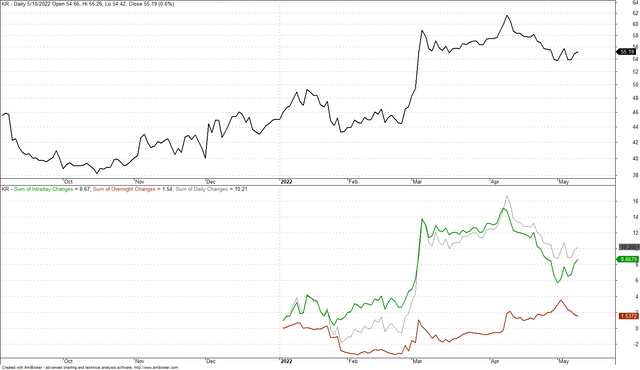

The Kroger Co. (KR)

Daily Chart of KR with RTH and ON Changes (Price Actin Lab Blog – Norgate Data)

The chart of daily KR prices shows the regular trading hours accumulation ($8.67), the overnight accumulation ($1.54), and the daily accumulation of $10.2, year-to-date.

Regular trading hours activity has subsided since the beginning of April but it’s still solid after the drop. The stock is up 22.5% year-to-date and it appears prices have made a bottom recently. There are good odds for another uptrend in KR after another break above $59.

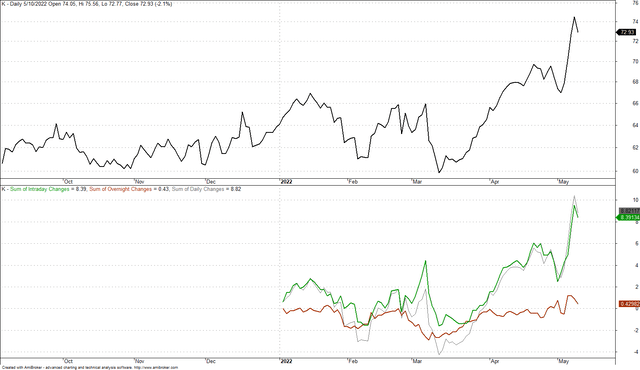

Kellogg Company (K)

Daily Chart of K with RTH and ON Changes (Price Action Lab Blog – Norgate Data)

The chart of daily K prices shows dynamic regular trading hours accumulation ($8.39), overnight accumulation of ($0.43), and daily accumulation of $8.82, year-to-date.

Regular trading hours activity increased in May. The stock is up 14.2% year-to-date and 2.2% below all-time highs. There could be additional gains in this stock with P/E TTM at 16.6 and an annual yield of 3.2%.

Summary: Four S&P 500 stocks from our analysis of regular trading hours and overnight activity show potential for further gains. These stocks are in sectors that are benefiting from the current economic and geopolitical environment. These four stocks are up year-to-date and also have positive regular trading hours and overnight gains.

Read More: 4 S&P 500 Stocks With Solid Regular Trading Hours Gains Year-To-Date